- Investment trends, challenges, and opportunities

- Financing innovations driving the energy transition

- Investment in sustainable mining practices

Investment trends, challenges, and opportunities

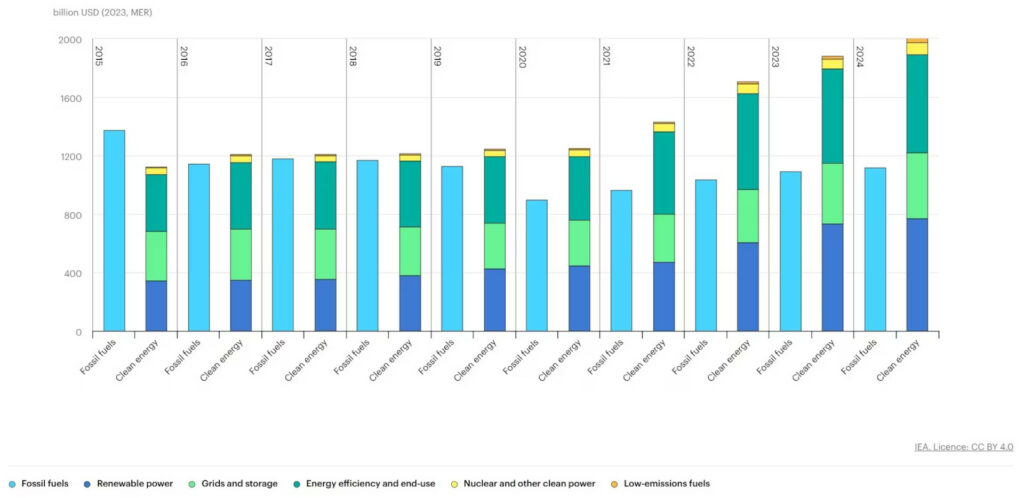

To achieve global net-zero emissions by 2050, the International Energy Agency estimates that annual clean energy investments must triple to $4 trillion by 2030. The scale of investment required spans renewable energy projects, electric vehicle infrastructure, and the modernization of aging energy grids. While the global clean energy market is increasing rapidly, access to financing is critical to unlocking more additional growth. This is particularly true in emerging economies, which need nearly $1 trillion annually to scale renewable energy solutions.

Over the past decade, institutional investors have responded to this challenge by pivoting towards clean energy. Major asset managers like BlackRock and Vanguard are integrating environmental, social, and governance (ESG) criteria into their investment strategies, signalling a shift toward sustainability-focused portfolios. For example, BlackRock provides investors with tools to assess climate-related risks and align investments with net-zero goals. While this trend reflects a broader commitment across financial markets to align with sustainability objectives, ESG has recently undergone a transformation as the model matures, notably attracting heightened scrutiny and criticism, especially in the U.S., as investors and regulators now demand greater transparency, deeper accountability, and tangible impact.

Governments are also leveraging public-private partnerships to accelerate the transition. For example, the EU’s InvestEU program aims to trigger more than €372 billion in private investments to high EU policy priority areas such as the energy transition, sustainability innovation, and social investments. This enabled the Baltic Power Offshore Wind Farm, a €4.5 billion joint venture between Orlen Group and Northland Power, which secured funding through this initiative, to begin building a 1.2 GW wind farm off the Polish north coast. Once it achieves its expected commercial operations in 2026, it will be able to supply more than 1.5 million households with clean energy. Such public-private partnerships demonstrate how public funding can de-risk projects, encouraging private sector participation.

Energy transition bonds have also emerged as a prominent financing tool. In 2024, total green bond issuance reached $670 billion globally, a 16% increase from 2023. Major renewable energy companies like Enel Green Power are leveraging these bonds to finance solar, wind, and hydrogen infrastructure projects. Enel’s issuance of sustainability-linked bonds has helped finance 6 gigawatts of additional renewable energy capacity, highlighting the power of innovative financing mechanisms to drive expansion.

Global investment in clean energy and fossil fuels, 2015-2024

Financing innovations driving the energy transition

Traditional financing methods are evolving rapidly to meet the unique needs of clean energy projects, with new innovations aligning capital deployment with sustainability and scalability. These innovations are essential to overcoming the barriers posed by high capital intensity, long payback periods, and market volatility in the energy transition.

Blended finance models have proven effective in mobilizing private capital for renewable energy projects in risk-prone markets. By combining public grants, concessional loans, and private equity, blended finance mechanisms reduce risk and attract institutional investors. For example, Climate Investment Funds have mobilized $8 billion for clean energy projects in over 50 developing countries, paving the way for private sector engagement. The Africa Renewable Energy Initiative leverages public funds to de-risk projects in sub-Saharan Africa, and has catalyzed over $15 billion in private investment since its inception. This model could be expanded to support clean energy projects in underfunded EU regions, such as Eastern Europe.

Tokenization is also emerging as a disruptive force in financing and offers a groundbreaking approach to democratize access to renewable energy investments. Blockchain-based platforms allow individual investors to own fractional shares of wind farms, solar plants, or battery storage projects. One example of this is WePower, an EU-based blockchain startup, which tokenizes green energy projects, enabling direct investment from small-scale contributors. These platforms not only broaden the investor base but also increase transparency and reduce administrative costs.

Sustainability-linked loans (SLLs) have gained traction as a financing mechanism tied to ESG performance. Borrowers who meet specified sustainability targets, such as reducing emissions or increasing renewable energy usage, benefit from lower interest rates. In 2023, Danish offshore wind leader Ønhrsted secured a €2 billion SLL and channelled the funds into new wind projects that align with the company’s carbon neutrality goals. This model incentivizes companies to meet ambitious sustainability benchmarks while providing favorable financial terms.

These innovations reflect the financial sector’s increasing sophistication in aligning investment mechanisms with the unique demands of the energy transition. Combining technological tools with financial engineering enables a more inclusive and scalable transition to clean energy.

Investment in sustainable mining practices

The mining industry plays a dual role in the energy transition by supplying the raw materials essential for renewable The energy transition depends on a reliable supply of critical minerals such as lithium, cobalt, copper, and nickel. Mining companies are responding to growing investor interest in sustainability by adopting cleaner technologies, improving supply chain transparency, and aligning operations with ESG criteria. These efforts help to ensure critical raw materials are sourced responsibly, supporting both financial and environmental objectives.

Leading mining companies are electrifying mining fleets and incorporating renewable energy into operations to reduce emissions. BHP is at the forefront of this transition, committing $4 billion to its Climate Transition Action Plan. The company has deployed battery-electric haul trucks and introduced solar energy at key sites, cutting diesel consumption significantly. Electrified operations not only reduce carbon footprints but also attract ESG-focused investors seeking sustainable mining practices.

Investors increasingly prioritize supply chain resilience, particularly for critical minerals like cobalt and nickel, while blockchain technology is revolutionizing transparency by tracing materials from extraction to end use. One example of this is Glencore, which in partnership with blockchain company Circulor, is able to track the cobalt that is produced from its mines in the Democratic Republic of Congo to ensure compliance with EU regulations. Such initiatives are vital for maintaining investor confidence and securing long-term funding.

Other sustainable mining practices, such as water management, waste reduction, and optimizing rock comminution are also becoming key focus areas for mining companies. Rio Tinto’s Oyu Tolgoi copper mine in Mongolia recycles 87% of its water, setting a benchmark for sustainable practices in water-scarce regions, and innovative comminution technology companies such as I-ROX, which seeks to recover more metal with less energy, improves productivity while reducing the emissions footprint of mining operations. As demand for critical minerals surges, mining companies that prioritize sustainable practices will be better positioned to secure investment, drive innovation, and support the energy transition.

I-ROX is open to industry input, collaboration and support – both financially and technically. If you are interested in discussing pulsed-power technology or any other element of collaboration, please contact us for more information.